No products in the cart.

September is National Preparedness Month: How to prepare with precious metals and tangible assets

With Hurricane Harvey just culminating, Hurricane Irma wreaking devastation across its path, and North Korea escalating its nuclear testing, September’s designation as National Preparedness Month has never been so apt. How do precious metals and tangible assets fit into disaster preparedness? What products and strategies does Highland Rare Coin recommend for ensuring you are financially prepared in times of distress, where recovery is an option?

The human mind is incredibly skilled at procrastination. We have great ideas only to put them on the backburner for an indefinite amount of time. Yet as we procrastinate, we also constantly worry about what might happen, creating stress and further inaction due to fear. Often, we approach financial preparedness with a fight or flight mentality, leading to overemotional decision making or no action at all. Tangible asset management is one of the areas that people move toward with either a calm, calculated approach, or a back-up-the-truck dystopic mindset. With the right acquisition strategy, you can have confidence that you are the former kind of investor.

How can you systematically acquire precious metals, rare coins, and tangible assets for financial security and peace of mind in times of distress, while also realizing returns in a normal investment environment? What are the best specific products to have on hand, and how can you best access them when needed?

We need only go back a few years to the Great Recession (2008-2011) to see how the holding of precious metals and tangible assets benefited investors as a buffer to the deep losses in the stock market. In the event of another downturn – even one not so severe – there are several things that can be done now, in a cycle where equities are high, real estate is high, Bitcoin is stratospheric, and interest rates are low, to build a portfolio of tangible assets to protect your future.

Figure out a number that you can put aside every month into precious metals.

It does not matter if it is $100 or $1,000; find an amount that you can put aside every month. Use these funds to buy precious metals in the form of gold or silver. Don’t get caught up with the notion that because silver is cheaper you should only buy silver. Create a monthly budget where you can eventually accumulate both gold and silver.

Research both Gold and Silver ETF’s.

These alternative investment methods can become your friend if metals markets begin a committed move upward. Putting aside $100 to $200 a month into a brokerage account for the sole purpose of being able to buy Calls on SLV and GLD when the time arrives is not a bad idea. Please consult your appropriate financial advisor for these types of trades.

Buy the right products.

This depends on your monthly allocation. It is important to read and understand all the IRS guidelines and regulations for the purchase and sale of precious metals, and their subsequent reporting forms. Assuming that has been done, we recommend buying the following products:

- American Gold Eagle Products in all denominations. Strive for a mix of 1 ounce, ½ ounce, ¼ ounce and ⅟₁₀ ounce gold coins.

- American Gold Buffalo’s

- American Silver Eagles

- South African Krugerrands

- Canadian Gold Maple Leaf’s

- Austrian Philharmonics

- Canadian Silver Maple Leaf’s

- Valcambi or Johnson Matthey kilo silver bars

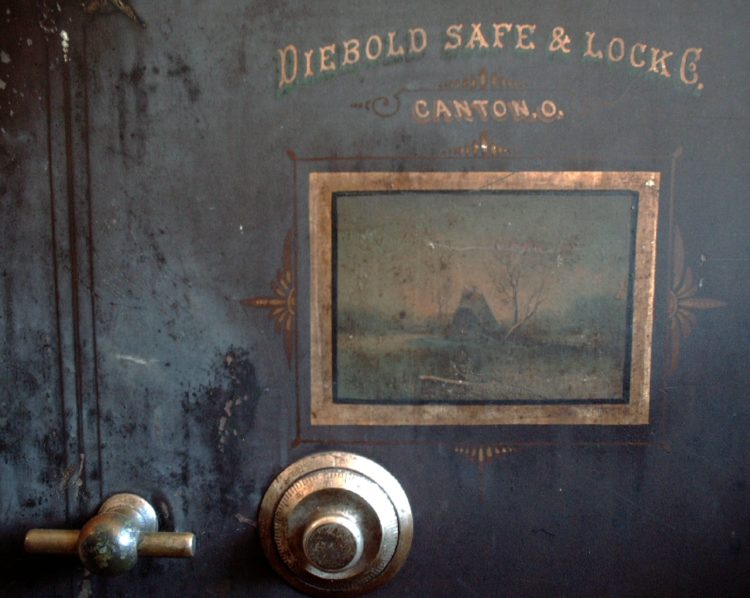

Storage Considerations.

Storing precious metals is serious business and it requires commitment and planning. As you start to accumulate precious metals, the first thing you need to do is to not discuss it with anyone except those you explicitly trust. Even then, be selective. I cannot tell you how many times we have heard stories of significant bullion and coin positions being stolen by trusted individuals. We would recommend only discussing it with an individual that could be counted upon to retrieve your precious metals in a time of emergency if you are out of town, incapacitated, or otherwise unable to access your tangible assets.

For significant amounts of precious metals, store them in a bank safety deposit box when times are not calamitous. We are aware of the concerns out there that banks can shut their doors or seize contents of safety deposit boxes. Yet, when times are relatively quiet, this is likely the best option for security and access.

For those that have the money, infrastructure, and discipline to be security-minded, keeping precious metals at home is a great alternative to use in conjunction with a safety deposit box, providing the most access. The downside is the increased threat to your personal security by having metals in your home. Even a random burglary could turn into a nightmare if the perpetrators find a large safe and you happen to be in the house at that time.

Plan on spending upwards of $6,000-$15,000 to secure your precious metals at home. You will need a TL-30 rated safe that is integrated into a security system that is monitored 24/7. You will also need to have the safe in an area that is not exposed to the public; for instance, don’t put it in the garage you use to park your car.

Now that we have discussed strategy and specifics on how to accumulate and store gold when times are in a relatively peaceful state, let’s look at some strategies when things are getting bad or looking like they could become catastrophic. Keep in mind, I am talking about negative events that will resolve and allow the individual to recover and return home at some point.

First, if there is clear indication that danger is imminent, remove your precious metals from any safety deposit box. If a good mixture of gold and silver has been accumulated, take all of the gold and some of the silver, depending on how much you can easily transport. Silver is bulky and heavy, and transportation can be an issue. If you think you are going to be on the move and will be using vehicles for transportation, there will be a tendency to leave the silver in the car—a big mistake.

This would also be a time where having a home safe setup becomes beneficial. Precious metals could easily be transferred to your home and secured. Along with physical needs like food, water, medicines, etc., you now have a good staging area to prepare for instructions from federal and state authorities, or to initiate your own emergency plan.

Second, if you are on the move, you will need to carry your precious metals with you. A proper backpack is invaluable for this. Get one that is made of 500 to 1000 Cordura fabric and is discreet. Remember, loose lips sink ships. We are now moving with precious metals into and out of environments that are unfamiliar to us or are highly dynamic with people under duress.

Finally, have some idea of where you will go to exchange your metals if you have been displaced. Keeping a map of trusted coin dealers/bullion dealers located in areas that you might end up in is a good idea. This will also be a time when you realize the benefit of having fractional gold coins as you might not need to cash in a 1 ounce gold coin every time you need money. When getting precious metals out of your backpack or secured compartment, do so in a private environment where no one can observe what you are doing and what you have.

I am often reminded of one of my fondest interactions with a couple that showcased plain and simple how effective tangible assets can be in times of great duress. Around 2007 I had a meeting in my office with a couple that had indicated they wanted to sell some gold coins they have held onto. They were a married couple, she was probably in her 80’s and he was in his early 90’s. Before ever even seeing their coins, they spoke of their lives and what they had endured. He had been a high ranking military official in the Polish army. Being of Jewish descent, when the Hitler-Nazi regime accelerated its advance through Europe, he had no choice but to flee. He and his wife took the gold coins, which consisted of Russian 5 and 10 rubles, and fled across Europe. Eventually landing in New York, they continued to make their way across the country to California where they settled and began a family. They did that entire process with the gold coins that they had in their possession.

Beginning a simple precious metals/tangible asset strategy can go a long way for peace of mind. Not only will it provide safety, liquidity and peace of mind in a disaster scenario, it will also provide a strong and liquid investment strategy as well.